Would You Be Prepared for an Unplanned Early Retirement?

Most of us would prefer not to think about an unexpected (and unwelcome) early retirement, but it does happen frequently.

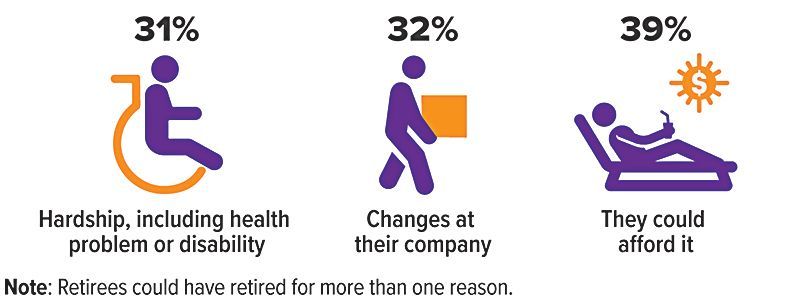

In fact, nearly half of current retirees retired earlier than planned, and of that group, more than 60% did so due to changes at their company or a hardship, such as disability.1 For that reason, it's a good idea to take certain steps now to help prepare for the unexpected.

What you can do now

Save as much as possible in tax-advantaged accounts.

If you're forced to retire earlier than planned, your work-sponsored retirement plans, IRAs, and health savings accounts (HSAs) could become critical resources. HSA assets can be used tax-free to pay for qualified medical expenses at any time, and you can generally tap your retirement plan and IRA assets after age 59½ without penalty. Although ordinary income taxes apply to distributions from pre-tax accounts, qualified withdrawals from Roth accounts are tax-free.2

In addition, the IRS has identified several situations in which retirement account holders may be able to take penalty-free early withdrawals. These include disability, terminal illness, leaving an employer after age 55 (work-based plans only),3 to pay for unreimbursed medical expenses that exceed 7.5% of your adjusted gross income, and to pay for health insurance premiums after a job loss (IRAs only).

Pay down debt.

Generally, it's wise to enter retirement (especially when unexpected) with as little debt as possible. Ensuring that your financial plan includes a strategy for paying down student loans, credit card debt, auto loans, and mortgages can help you minimize your income needs later in life.

Know your bare-bones budget.

Another way to help cushion the shock of an unexpected early retirement is knowing exactly how much you spend each month on your basic necessities, including housing, food, utilities, transportation, and health care. Maintaining a written budget throughout life's ups and downs will help you quickly identify how much income you'd need over the short term while you work on a longer-term income-replacement strategy.

Maintain adequate levels of disability insurance.

Your employer may offer group coverage at reduced rates; however, you lose those benefits if your employment is terminated. Private disability income insurance can help you secure coverage specific to your needs, and since the premiums are typically paid with after-tax dollars, any benefits would generally be tax-free (unlike work-sponsored coverage that is paid with pre-tax dollars).

Understand Social Security benefits.

If you stop working due to disability, you may qualify for Social Security Disability Insurance benefits if you meet certain requirements. You must have earned a certain number of work credits in a job covered by Social Security and have a physical or mental impairment that has lasted or is expected to last at least 12 months or result in death. If you remain eligible, benefits may continue up to age 65 and then convert to Social Security retirement benefits.

If you need to retire earlier than planned for reasons unrelated to disability and are eligible for Social Security retirement benefits, you can apply as early as age 62. However, starting payments prior to your full retirement age (66 or 67, depending on year of birth) will result in a permanently reduced monthly benefit.

For more information on Social Security disability and retirement benefits, visit the Social Security Administration's website at ssa.gov.

Consider your health insurance options.

Terminating employment prior to age 65 could leave you without health insurance. You may opt to continue your employer-sponsored health coverage for a limited period (permitted through COBRA, the Consolidated Omnibus Reconciliation Act), although this can be quite expensive. If you're married and your spouse works, you may get coverage under their plan. You may also seek coverage through the federal or a state-based health insurance marketplace. If you receive Social Security disability benefits, you'd automatically qualify for Medicare after 24 months.

Why 49% of Retirees Retired Earlier Than Planned

Don't be caught off guard

Don't wait for an unwelcome surprise. Take steps now to help ensure your overall financial plan considers the "what-if" of an unexpected early retirement.

(1) Employee Benefit Research Institute, 2024

(2) Qualified Roth withdrawals are those made after a five-year holding period and after the account owner dies, becomes disabled, or reaches age 59½. The penalty for early retirement account distributions and nonqualified withdrawals from Roth accounts is 10%. Nonqualified withdrawals from HSAs will be subject to ordinary income tax and a 20% penalty. After age 65, individuals can take money out of HSAs penalty-free, but regular income taxes will apply to funds not used for qualified medical purposes.

(3) Age 50 or after 25 years of service for public safety officers

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.