Consider Munis for Tax-Free Income

In 2024, the municipal bond market saw record trading for the third consecutive year.

New issues also set a record at $508 billion, the first time muni issues exceeded $500 billion. The trend continued through the first quarter of 2025, with trades and new issues both higher than the first quarter of 2024.1

This increased activity was primarily driven by individual investors attracted to higher yields that coincided with the Federal Reserve raising interest rates to combat inflation.2 Although the Fed has begun to lower rates, they may remain relatively elevated for some time, which could continue to support solid bond yields. Moreover, bonds purchased in a higher rate environment will typically increase in value on the secondary market as interest rates decline. Like other bonds, munis can help steady a portfolio during times of stock market turbulence and provide income regardless of market trends.

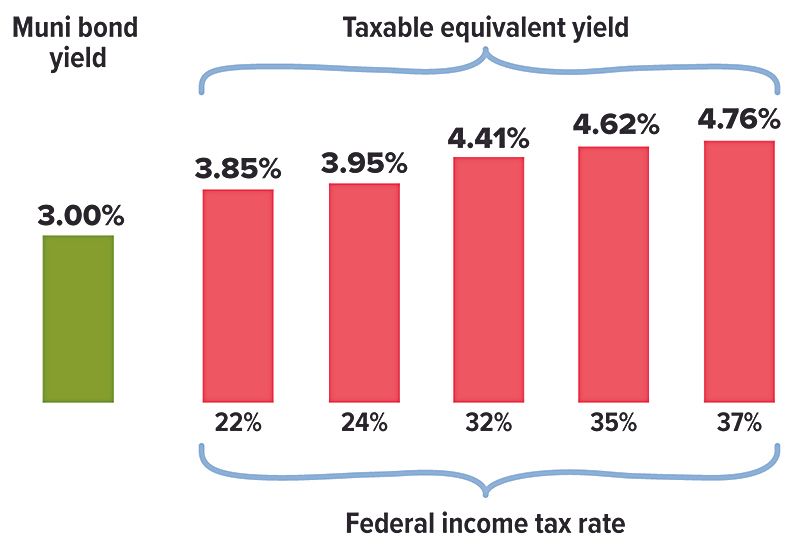

The primary appeal of municipal bonds as opposed to Treasuries or corporate bonds is that the interest is generally exempt from federal income tax, as well as from state or local taxes if you live in the state where the bond was issued. (Treasuries are generally exempt from state taxes but not federal taxes.) The tax-free yield may be higher than the after-tax yield on taxable bonds, especially for investors in higher tax brackets (see chart).

Government borrowing

Munis are debt obligations issued by state and local government entities. They typically fall into one of two categories.

General obligation bonds are issued to raise capital immediately, usually to cover expenses or refinance public debt. They are commonly repaid through taxes levied by the issuing agency.

Revenue bonds are issued to fund specific revenue-generating projects, such as utilities, sports stadiums, redevelopment projects, and toll roads. These bonds are typically repaid from the revenues generated by the finished projects.

Risk, ratings, and funds

Like all bonds, munis are rated for credit risk. A range of AAA down to BBB (or Baa) is considered "investment grade," and lower-rated or "junk" bonds are considered to carry high risk. Some bonds may also be insured, with a separate credit rating for the insurer. However, bonds should not be purchased based solely on insurance. In general, munis carry more risk than Treasuries but less risk than corporate bonds.

Municipal bond funds spread risk across many individual bonds. Some muni funds focus on bonds from specific states and may also include bonds from U.S. territories that are not subject to state taxes, making the fund's interest income tax free for investors who live in the targeted state.

The return and principal value of bonds and bond fund shares fluctuate with changes in market conditions. When redeemed, they may be worth more or less than their original cost. Bond funds are subject to the same inflation, interest-rate, and credit risks associated with their underlying bonds. As interest rates rise, bond prices typically fall, which can adversely affect a bond fund's performance. Conversely, as interest rates fall, bond prices typically rise, which can boost a fund's performance. Investments offering the potential for higher rates of return involve a higher degree of risk.

U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities fluctuates with market conditions. If not held to maturity, they could be worth more or less than the original amount paid.

Funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

(1–2) Municipal Securities Rulemaking Board, January 2025 and April 2025

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.