Keeping Cool in Volatile Markets

On April 2, 2025, President Trump announced sweeping tariffs that were larger and different in structure than expected.

Over the next two days, the S&P 500 Index plunged by 10.5%. The Dow Jones Industrial Average lost 9.3%, and the tech-heavy NASDAQ Index dropped 11.4%.1 The two-day rout erased $6.6 trillion in market value, the largest two-day loss of shareholder value in U.S. history.2

Faced with such a dramatic downturn, some investors might panic and sell their stocks. But if they did, they would have missed the equally dramatic bounceback the next week, after Trump announced a 90-day pause on most of the new tariffs. Stocks soared on April 9, with the S&P 500 gaining 9.5%, the largest one-day gain since 2008.3 Although volatility continued, the index set a new record by the end of June and more records over the following months. The Dow and NASDAQ also bounced back to record highs.4

Tune out the noise

It's likely that the tariff program will continue to influence the stock market for some time, as will decisions around interest rates and other economic news. The media generates reports 24 hours a day, and you can check the market anywhere you carry a mobile device. This barrage of information might make you feel that you should buy or sell investments in response to the latest news or market movement. But as the events of April 2025 illustrate, it's generally not wise to react emotionally to market swings or to news that you think might affect the market.

Historically, some of the best days of stock market performance have followed some of the worst days. Pulling out of the market due to an emotional reaction can lead to missing gains on the way back up. On the other hand, buying heavily just because the market is rising could mean overcommitting at higher prices.

Stay the course

The market will always move up and down, but the long-term trend has been upward for almost a century, the period covered by modern analysis. Since 1928, the S&P 500 Index has returned an annual average of about 10%.5 Annual returns have varied widely, but, on average, bull markets have lasted over three times longer than bear markets and gained over three times more than bear markets have lost.6

Consider this advice from famed investor and mutual fund industry pioneer John Bogle: "Stay the course. Regardless of what happens in the markets, stick to your investment program. Changing your strategy at the wrong time can be the single most devastating mistake you can make as an investor."7

This doesn't mean you should never buy or sell investments. However, the investments you buy and sell should be based on a sound strategy appropriate for your risk tolerance, financial goals, and timeframe. And a sound investment strategy could help carry you through market ups and downs.

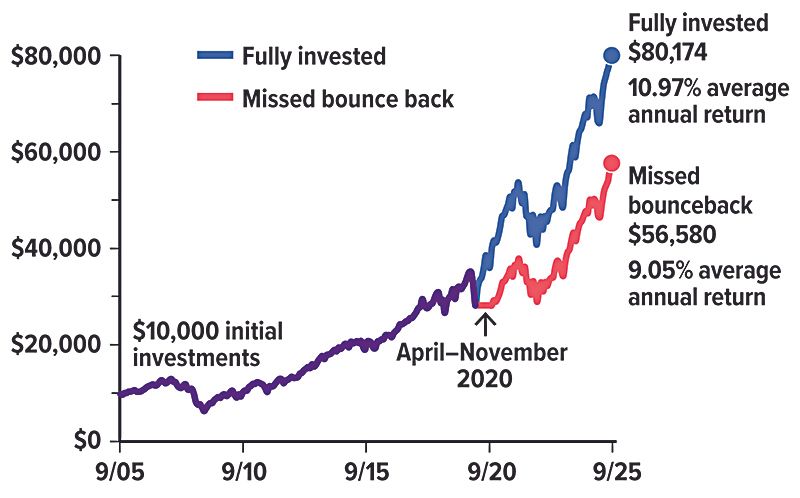

Missing the Bounceback

The best two months of stock market performance during the last 20 years came in April and November 2020, immediately after the pandemic bear market plunge. An investor who sold in March 2020 and missed the period from April to November would have received only about 70% of the 20-year return of an investor who stayed fully invested.

Be calm

It can be tough to remain calm when you see the market dropping or to control your exuberance when you see it shooting upward. But overreacting to market movements or trying to "time the market" by guessing its future direction can create additional risk that could negatively affect your long-term portfolio performance.

All investments are subject to market fluctuation, risk, and loss of principal. When sold, investments may be worth more or less than their original cost. The S&P 500 Index is an unmanaged group of securities considered representative of the U.S. stock market in general. The performance of an unmanaged index is not indicative of the performance of any specific investment. Individuals cannot invest directly in an index. Actual results will vary.

(1) and (4) Yahoo Finance, April 7, 2025, and September 4, 2025

(2) Morningstar, April 4, 2025

(3) CBS News, April 10, 2025

(5) Investopedia, May 16, 2025

(6) Yardeni Research, January 21, 2024

(7) MarketWatch, June 6, 2017

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.