Q and A on RMDs

Tax-deferred retirement savings accounts, including IRAs and employer-based plans, are an appropriate way to build assets.

Your accounts can potentially grow without losing ground to income taxes each year, and depending on the account type and your income level, you may also benefit from a tax deduction for your contributions.

However, with traditional, non-Roth accounts, you can't defer taxes indefinitely. The IRS will eventually get its share through what's known as required minimum distributions (RMDs).1

What are RMDs?

RMDs are annual distributions that must be taken from traditional, non-Roth IRAs and employer plans once you reach a certain age. If you were born from 1951 to 1959, you must begin RMDs after you reach age 73. If you were born in 1960 or later, your RMD age is 75. There is one exception to this rule: If you work beyond RMD age and you're not a 5% owner of your company, you can defer RMDs from your current employer's plan until you retire. You'll still be required to take RMDs from any previous employer plans.

Which accounts are subject to RMDs?

Traditional IRAs, SEP IRAs, SIMPLE IRAs, SARSEPS, and all work-based retirement plans — including 401(k), 403(b), 457(b), and profit-sharing plans — are all subject to RMDs.

How much must I withdraw?

RMDs are calculated based on the value of your account as of the previous December 31, divided by a life expectancy factor published in tables included in IRS Publication 590-B. There are three different tables, each of which applies to certain situations.

For example, say you reach age 73 in 2026 and your work-based retirement plan account was worth $750,000 on December 31, 2025. Assuming you use Table III, the Uniform Lifetime table, your plan account RMD for 2026 would be $28,302 ($750,000 ÷ 26.5).

You must calculate RMDs for each account you own. With IRAs, the IRS allows you to total all RMD amounts and take your distribution from one IRA. Similar rules apply to 403(b) plans. With other work-based plans, you must calculate your RMD and take a distribution separately from each account.

You can always withdraw more than the required amount in any given year.

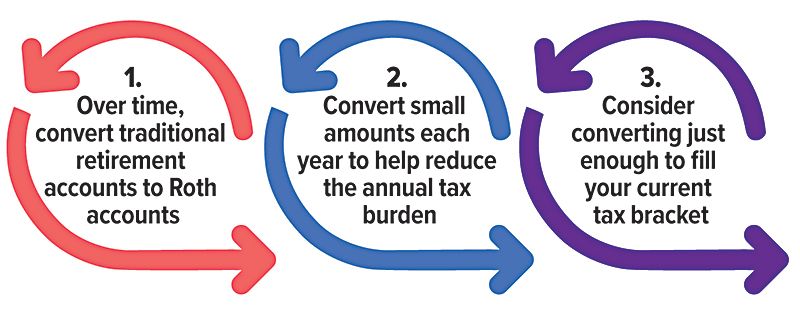

Another Tax Strategy: Consider Roth Conversions

Roth conversions are taxable events, but they may help reduce RMDs later.

How they work:

How do RMDs affect my income taxes?

RMDs (except amounts that were previously taxed, i.e., non-deductible contributions) are reported as taxable income. Consequently, a large RMD could result in a sizeable tax obligation.

Generally, you must take RMDs by December 31 each year; however, you may delay your first RMD until April 1 of the year following the year you reach RMD age. Keep in mind that your second RMD will be still be required by December 31 of that same year, which could significantly increase your income taxes.

In addition, neglecting to withdraw the required amount can result in a penalty tax of 25% of the difference between what you should have withdrawn and the actual distribution. This amount may be reduced to 10% or even waived entirely if corrected as soon as possible within two years (see IRS Form 5329 and associated instructions).

One way to satisfy your annual IRA RMD without increasing your tax burden is to make a qualified charitable distribution (QCD). A QCD is a charitable contribution made directly from your IRA trustee to a qualified charity of your choice. Although QCDs are not tax deductible, you can exclude up to $111,000 in 2026 ($222,000 if you're married filing jointly) in QCDs from your gross income.2

1Unlike traditional accounts, Roth accounts don't offer tax-deductible contributions. Withdrawals from traditional accounts prior to age 59½ and non-qualified withdrawals from Roth accounts are subject to ordinary income taxes and a 10% early distribution penalty, unless an exception applies. Qualified withdrawals from Roth accounts are those made after a five-year holding period and the participant reaches age 59½, dies, or becomes disabled. Roth accounts are not subject to RMDs during the account owner's lifetime, but most Roth account beneficiaries, like traditional account beneficiaries, are subject to highly complex RMD rules beyond the scope of this article. For more information, speak with a tax professional.

(2) QCDs are not permitted from employer plans

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.