Home Energy Rebates Could Save You Money

The Inflation Reduction Act of 2022 included two provisions allowing rebates for home energy efficiency retrofit projects and home electrification and appliance projects.

These home energy rebate programs are to be administered by state energy offices, with the U.S. Department of Energy (DOE) providing guidance and oversight.

Many states have applied for or have received optional early funding to jumpstart their home energy rebate programs. Rebates are available in some states starting in 2024 (possibly delayed until 2025 for others). The DOE tracks the application progress of states on energy.gov.

What are the DOE home energy rebates?

There are two DOE home energy rebates and various factors help determine the amount of rebates that may be available.

For a home energy efficiency retrofit project with at least 20% predicted energy savings, a rebate may be available per household for 80% of project costs, up to $4,000 (reduced to 50% of project costs, up to $2,000, if household income is above 80% of area median income (AMI)). For a home energy efficiency retrofit project with at least 35% predicted energy savings, a rebate may be available per household for 80% of project costs, up to $8,000 (reduced to 50% of project costs, up to $4,000, if household income is above 80% of AMI).

For a home electrification and appliance project, a rebate may be available per household for 100% of project costs, up to specific technology cost maximums, with a maximum total of $14,000. The 100% of project costs limit is reduced to 50% if household income is above 80% of AMI. This rebate is not available if household income is above 150% of AMI. The specific technology cost maximums range from $840 for an Energy Star electric stove to $8,000 for an Energy Star electric heat pump for space heating and cooling.

An installed technology may be eligible for rebates either because of its predicted energy savings or because of its inclusion on the home electrification project qualified technologies list, but not for both reasons in a single household.

Tax treatment of DOE home energy rebates

A rebate paid to or on behalf of a purchaser participating in either of the DOE home energy rebate programs is not includible in the purchaser's gross income and will be treated as a purchase price adjustment. This means that to the extent the rebate is provided at the time of sale, the rebate is not included in the purchaser's cost (or tax) basis in the property. If the rebate is provided later, the tax basis is reduced.

Payments of rebate amounts made directly to a business taxpayer, such as a contractor, in connection with the business taxpayer's sale of goods or provision of services to a purchaser are includible in the business taxpayer's income.

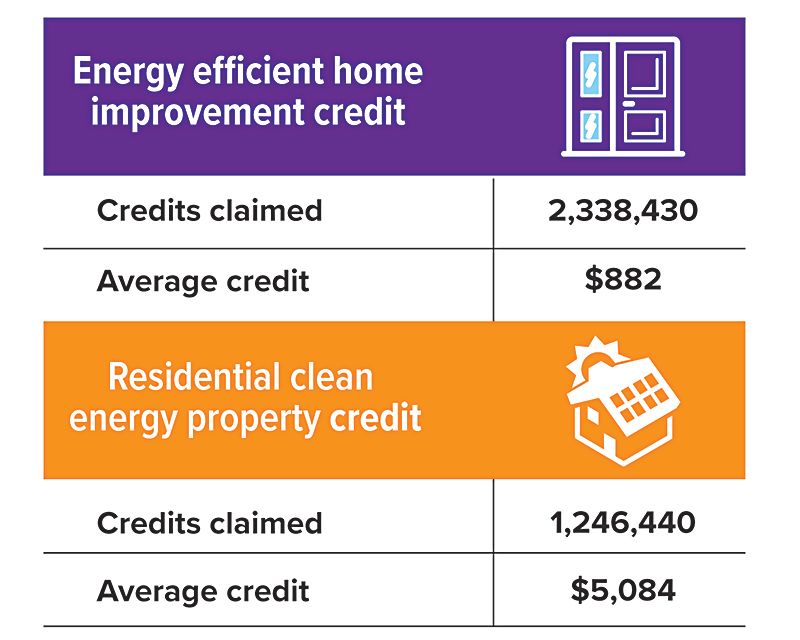

Coordination with the energy efficient home improvement credit

In some cases, a taxpayer can receive an energy efficient home improvement credit for federal income tax purposes. The credit is for 30% of amounts paid for certain qualified expenditures, with limits on the allowable annual credit and on the amount of credit for certain types of qualified expenditures. The maximum annual credit amount may be up to $3,200.

If the taxpayer receives a DOE home energy rebate (whether at the time of sale or later), the amount of qualified expenditures used to calculate the energy efficient home improvement credit must be reduced by the amount of the rebate. If the taxpayer purchases items eligible for both the DOE home energy rebate and the energy efficient home improvement credit, the taxpayer can make a pro rata allocation of amounts received as rebates to the individually itemized expenditures as a share of total project cost in determining the amounts treated as paid or incurred for such items for purpose of the credit. The allocated rebate amounts reduce the qualified expenditures to which they are allocated, and the various limits on costs under the energy efficient home improvement credit are then applied.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.