Life Insurance Might Help During Turbulent Economic Times

During times of economic uncertainty and when the stock market is volatile, life insurance may be a useful tool to consider.

Income protection

Finances that were intended to provide support for you and your family could take a hit due to stock market volatility. In addition, rising costs of goods and services might eat into more of your income and savings. If you die, life insurance can be used to help replace some of the savings you may have lost during turbulent economic times. The tax-free death benefit may be used to help provide income to your spouse and family, pay off mortgages and loans, meet tax liabilities, or pay for college expenses.

Portfolio diversification

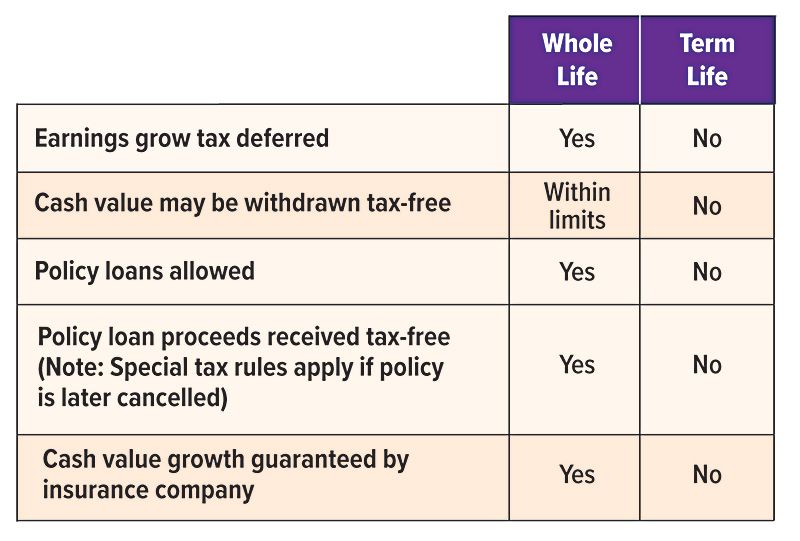

Certain types of permanent life insurance have a cash value option that can be beneficial during times of economic uncertainty. Some policies offer minimum interest rate guarantees (subject to the financial strength and claims-paying ability of the issuer) that may provide an alternative to the unpredictability of the stock market.

Wealth accumulation

Cash value life insurance may allow all interest and earnings on the policy's accumulations to grow tax deferred. You might even be able to take withdrawals from the cash accumulation of the life insurance policy. Any withdrawal you make will typically be tax-free up to your basis (i.e., premiums paid) in the policy. Because any earnings grow tax deferred while inside the policy, they will be subject to income tax when you withdraw them. Withdrawals coming out of your policy are generally treated as basis first. Be aware that surrender charges may also apply when you withdraw from your policy, even if you withdraw only up to your basis. One way to help circumvent this and still access your policy's accumulations is to take out a policy loan from the insurance company, using the cash value in the policy as collateral. The amount you borrow is generally not treated as taxable income as long as you repay the loan, and there are no surrender charges because you're not actually withdrawing your money. But you'll have to pay interest on the loan, which is not tax deductible.

Living benefits

Life insurance could help replace lost funds should you become disabled, need long-term care, or face a terminal illness. For example, if you are terminally ill, you might be able to receive a portion of the death proceeds from your life insurance before you die in order to pay necessary expenses. Some life insurance policies include a special rider that allows you to accelerate your life insurance death benefit if you need long-term care. Other riders may be added to a life insurance policy that could help in the event you become disabled and are unable to work.

Optional benefit riders are available for an additional fee and are subject to contractual terms, conditions and limitations as outlined in the policy and may not benefit all investors. Any payments used for covered long-term care expenses would reduce (and are limited to) the death benefit or annuity value and can be much less than those of a typical long-term care policy. As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Any guarantees are subject to the financial strength and claims-paying ability of the insurance issuer. Loans and withdrawals from a permanent life insurance policy will reduce the policy's cash value and death benefit, could increase the chance that the policy will lapse, and might result in a tax liability if the policy terminates before the death of the insured. Additional out-of-pocket payments may be needed if actual dividends or investment returns decrease, if you withdraw policy cash values, or if current charges increase.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.