How Has SECURE 2.0 Affected 401(k) Plans?

Since its inception in 1980, the 401(k) plan has become a key tool in helping Americans build wealth.

In fact, the number of people who have become millionaires through their 401(k) plans reached 537,000 in 2024, a 27% increase from 2023.1 The SECURE 2.0 Act, passed in 2022, introduced new features designed to make 401(k)s even more appealing to workers. The following features are optional for employers, and while some have been adopted, others have yet to gain traction.

Emergency access

In most cases, early withdrawals from 401(k) plans are subject to ordinary income tax and an additional 10% early distribution penalty. However, there are certain exceptions to the penalty, including several introduced by SECURE 2.0:

- Withdrawals of up to $1,000 for personal or family emergencies

- Distributions of up to $22,000 for expenses related to a federally declared natural disaster

- Withdrawals of up to the lesser of $10,500 (in 2025) or half the account balance for an account holder who is the victim of domestic abuse

- Distributions to a terminally ill employee

In addition, SECURE 2.0 ushered in a new option to help employees save for emergencies, known as a pension-linked emergency savings account (PLESA). Also called a "sidecar" account, a PLESA allows workers to make Roth-type contributions, which means they are not tax deductible, but withdrawals are tax-free. Employees can save up to $2,500 each year (or a lower limit, as determined by the employer), and money is invested in lower-risk vehicles. Employees are allowed to make withdrawals at least once per month, generally for any reason.

SECURE 2.0 also authorized employers to allow workers to "self-certify" their need for hardship withdrawals, which are distributions permitted in certain situations if the employee has limited financial resources. Previously, employees were required to prove they had an "immediate and heavy financial need" for the money. (Note that hardship withdrawals and $1,000 emergency withdrawals are different types of distributions.)

Super catch-ups

Catch-up contributions, which allow employees age 50 and older to contribute more to their 401(k) plans than younger workers, have existed since 2001. Thanks to SECURE 2.0, employers may now allow workers who reach age 60 to 63 during the year to contribute even more through what have become known as "super catch-ups." In 2025, all 401(k) plan participants can contribute up to $23,500. Employees age 50 to 59 and 64 and older can contribute an additional $7,500, and those who reach age 60 to 63 can contribute an additional $11,250. These limits are indexed to inflation, which means they are periodically increased.

Student loan match

This program is designed to help alleviate the risk that some workers may be unable to save for retirement while paying off student debt. Through the student loan match, employers can make matching contributions into a retirement savings account based on an employee's student loan payments.

Roth match

With this option, employees can have their employer matching and non-elective contributions invested on a Roth, rather than a pre-tax, basis. The benefit is that, under current law, this feature can help workers build a source of potentially tax-free retirement income, provided certain conditions are met. A Roth distribution is tax-free if it is made after the account has been held for at least five years and the employee reaches age 59½, dies, or becomes disabled.

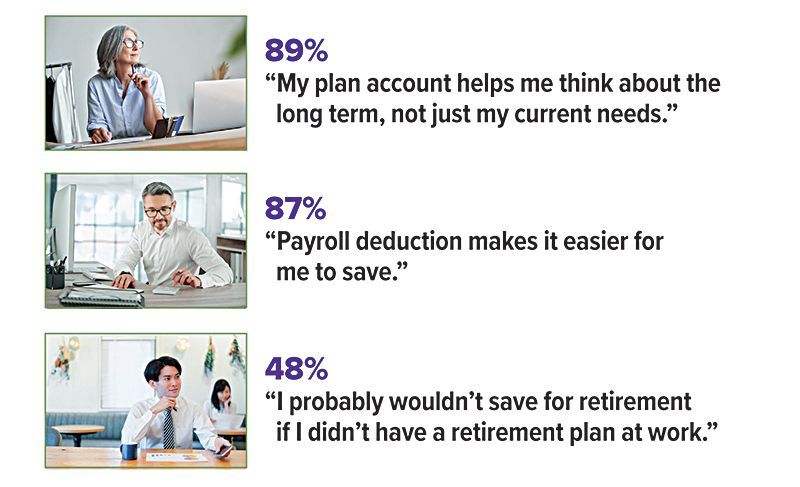

401(k) Appreciation Day

Percentage of retirement plan participants who agree with the following statements:

Which features are being adopted?

The new exceptions to the 10% penalty, the self-certification for hardship withdrawals, the super catch-ups, and the Roth matches are among the new plan features employers are adopting. On the other hand, employers have been slow to launch PLESAs and offer the student loan match. Industry observers indicate it may be due to the technology and/or added administrative burden these features require. In the case of the student loan match, some plan sponsors have noted that not enough employees have a need for the benefit.2

(1) MarketWatch, February 27, 2025

(2) Plansponsor.com, February 3, 2025; PSCA.org, January 21, 2025; Alight, 2025

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.