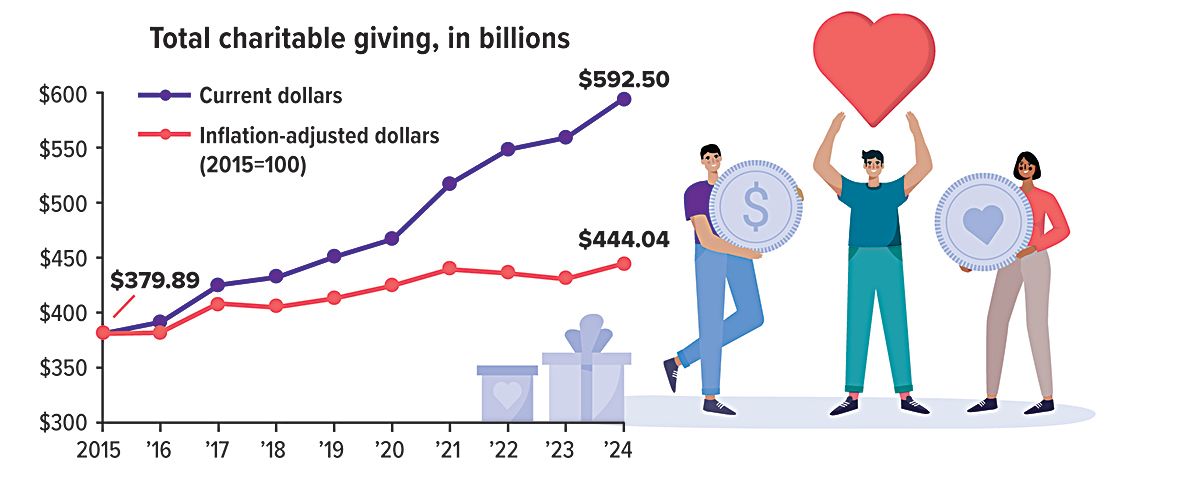

Record Charitable Giving in 2024

U.S. charities received a record $592.50 billion in 2024, an increase of 6.3% over 2023, driven by a strong stock market and healthy economy. Due to generous giving and lower inflation, this was the first year since 2021 that the increase in giving outpaced inflation. As in previous years, individuals led the way, accounting for 66% of contributions, followed by foundations (19%), bequests (8%), and corporations (7%).

Over the last decade, giving has risen each year in current dollars but has not always kept up with inflation. It remains to be seen how the uneven economy and volatile investment climate have influenced giving in 2025. Changes to the tax treatment of charitable contributions effective in 2026 may impact future giving.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.