Key Retirement and Tax Numbers for 2023

Every year, the Internal Revenue Service announces cost-of-living adjustments that affect contribution limits for retirement plans and various tax deduction, exclusion, exemption, and threshold amounts.

Here are a few of the key adjustments for 2023.

Estate, Gift, and Generation-Skipping Transfer Tax

- The annual gift tax exclusion (and annual generation-skipping transfer tax exclusion) for 2023 is $17,000, up from $16,000 in 2022.

- The gift and estate tax basic exclusion amount (and generation-skipping transfer tax exemption) for 2023 is $12,920,000, up from $12,060,000 in 2022.

Standard Deduction

A taxpayer can generally choose to itemize certain deductions or claim a standard deduction on the federal income tax return. In 2023, the standard deduction is:

- $13,850 (up from $12,950 in 2022) for single filers or married individuals filing separate returns

- $27,700 (up from $25,900 in 2022) for married joint filers

- $20,800 (up from $19,400 in 2022) for heads of household

The additional standard deduction amount for the blind and those age 65 or older in 2023 is:

- $1,850 (up from $1,750 in 2022) for single filers and heads of household

- $1,500 (up from $1,400 in 2022) for all other filing statuses

Special rules apply for those who can be claimed as a dependent by another taxpayer.

IRAs

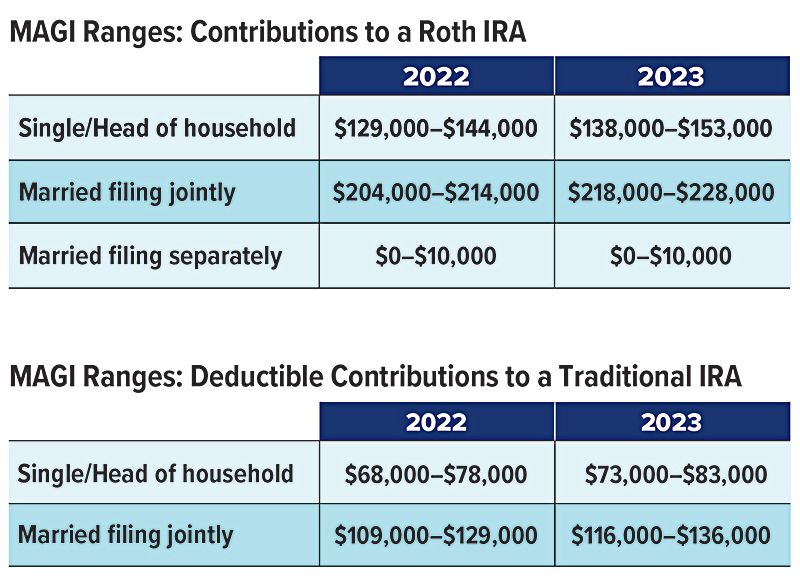

The combined annual limit on contributions to traditional and Roth IRAs is $6,500 in 2023 (up from $6,000 in 2022), with individuals age 50 or older able to contribute an additional $1,000. The limit on contributions to a Roth IRA phases out for certain modified adjusted gross income (MAGI) ranges (see chart). For individuals who are active participants in an employer-sponsored retirement plan, the deduction for contributions to a traditional IRA also phases out for certain MAGI ranges (see chart). The limit on nondeductible contributions to a traditional IRA is not subject to phaseout based on MAGI.

Employer-Sponsored Retirement Plans

- Employees who participate in 401(k), 403(b), and most 457 plans can defer up to $22,500 in compensation in 2023 (up from $20,500 in 2022); employees age 50 or older can defer up to an additional $7,500 in 2023 (up from $6,500 in 2022).

- Employees participating in a SIMPLE retirement plan can defer up to $15,500 in 2023 (up from $14,000 in 2022), and employees age 50 or older can defer up to an additional $3,500 in 2023 (up from $3,000 in 2022).

Kiddie Tax: Child's Unearned Income

Under the kiddie tax, a child's unearned income above $2,500 in 2023 (up from $2,300 in 2022) is taxed using the parents' tax rates.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.