Creating Your Own Operation London Bridge

"London Bridge is down." On September 8, 2022, those words were reportedly used to launch what was arguably the most complex end-of-life proceedings the world has ever witnessed: the funeral arrangements for Queen Elizabeth II.

The plan, known as Operation London Bridge, laid out in exacting detail how the ensuing days would unfold. Although most families don't need a playbook as intricate as the royals, a comprehensive end-of-life plan can significantly ease the burden on family members during a highly emotional period.

Guidance in a Medical Crisis

What would happen if you became incapacitated and could not make financial or medical decisions for yourself? To help ensure that your affairs continue to be managed by someone you trust and according to your wishes, you might consider creating a durable power of attorney (DPOA) and an advance medical directive.

A DPOA authorizes someone to manage your finances on your behalf, while a medical directive documents your wishes for medical care, such as whether you want extraordinary measures to prolong life if there is no chance of recovery. There are several types of DPOAs and advance medical directives; each has its own purpose, benefits, and drawbacks and may not be effective in some states.

Funeral Instructions

Planning your funeral or similar commemoration can relieve significant stress on your family members. Decisions would typically cover whether you want a burial or cremation, a wake with or without viewing, a religious ceremony or secular event, and could include details such as music, readings, speakers/clergy, flowers, venues, and an obituary. You might discuss thoughts with family members, taking their ideas into consideration. You might also consult a trusted funeral director who can help you navigate the various options, decide whether to prepay for arrangements, and become a valuable resource to your family when the time comes.

Estate Management

The most fundamental components of an estate plan are also among the most important: a will and a letter of instruction.

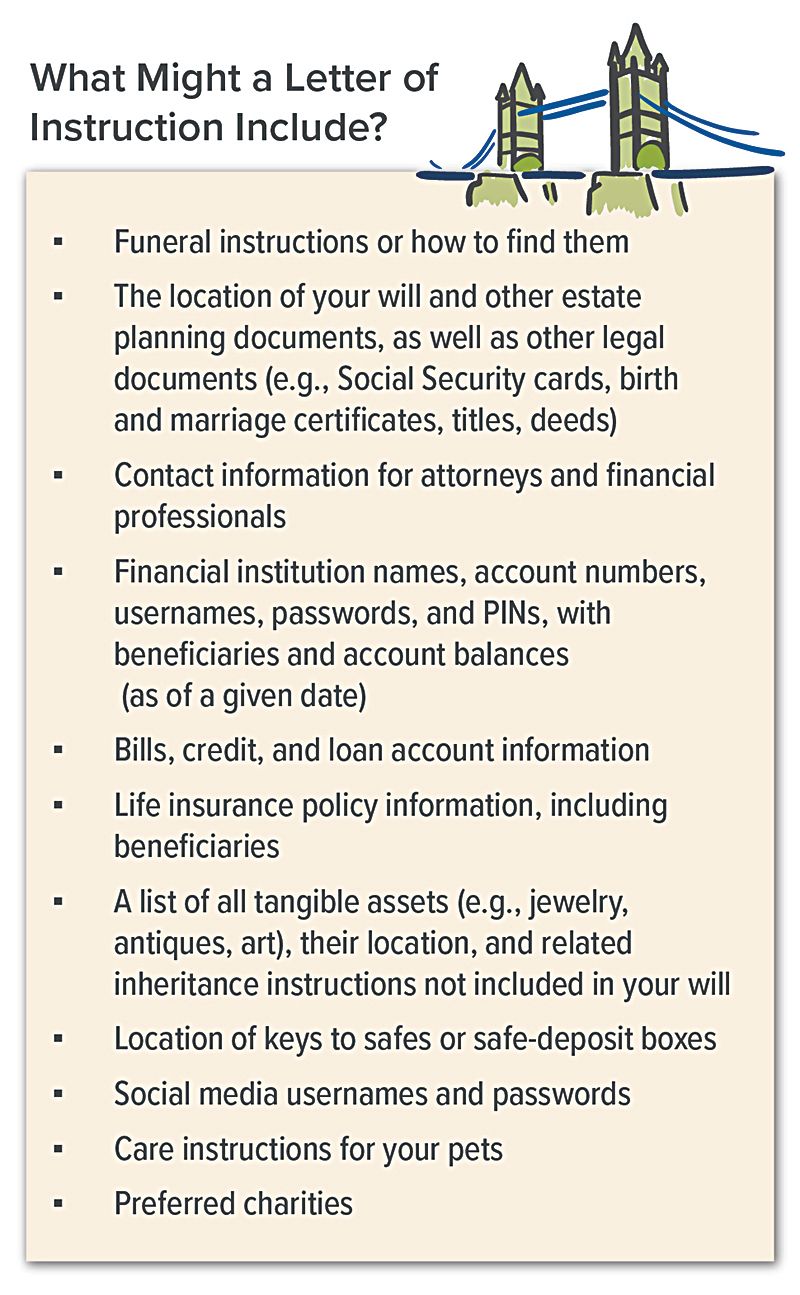

A will states how you wish to disburse your assets, names an executor to act as your legal representative, provides guidance for the management of your financial affairs, and (if appropriate) identifies who you want to be guardian of your minor children and their assets. A letter of instruction has no legal status but provides vital details that complement your will (see graphic).

You might also familiarize yourself with the death-related tax rules at both the federal and state levels. The 2023 federal estate tax exemption is $12.92 million. Although that sounds like a lot, 17 states impose their own estate and/or inheritance tax — most at much lower thresholds. When you consider that an estate includes the value of your home, insurance policies, retirement plans, and other assets, it may be easier than you'd expect to trigger a taxable situation. (Estate tax is imposed on the estate of the deceased, while an inheritance tax is imposed on the beneficiary.)

Seek Assistance

For more information on how to create your own Operation London Bridge, contact an estate planning attorney. Once your plan is established, store all documents in a safe place and communicate its location to your executor.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.