Investor, Know Thyself: How Your Biases Can Affect Investment Decisions

Traditional economic models are based on the premise that people make rational decisions to maximize economic and financial benefits.

In reality, most humans don't make decisions like robots. While logic does guide us, feelings and emotions — such as fear, excitement, and a desire to be part of the "in" crowd — are also at work.

In recent decades, another school of thought has emerged. This field — known as behavioral economics or behavioral finance — has identified unconscious cognitive biases that can influence even the most stoic investor. Understanding these biases may help you avoid questionable financial decisions.

Sound familiar?

What follows is a brief summary of how some common biases can influence financial decision-making. Can you relate to any of these scenarios?

Anchoring refers to the tendency to become attached to something, even when it may not make sense. Examples include a home that becomes too much to care for or a piece of information that is believed to be true despite contradictory evidence. In investing, it can refer to the tendency to hold an investment too long or rely too much on a certain piece of data or information.

Loss aversion bias describes the tendency to fear losses more than to celebrate gains. For example, you may experience joy at the chance of becoming $5,000 richer, but the fear of losing $5,000 might provoke a far greater anxiety, causing you to take on less investment risk than might be necessary to pursue your goals.

The endowment effect is similar to anchoring in that it encourages you to "endow" what you currently own with a greater value than other possibilities. You may presume the investments in your portfolio are of higher quality than other available alternatives, simply because you own them.

Overconfidence is having so much confidence in your own ability to select investments that you might discount warning signals or the perspective of more experienced professionals.

Confirmation bias is the tendency to assign more authority to opinions that agree with your own. For example, you might give more credence to an analyst report that favors a stock you recently purchased, in spite of several other reports indicating a neutral or negative outlook.

The bandwagon effect, also known as herd behavior, happens when decisions are made simply because "everyone else is doing it." This can result in buying high and selling low — what most knowledgeable investors strive to avoid.

Recency bias refers to the fact that recent events can have a stronger influence on your decisions than those in the past. For example, if you were severely affected by market gyrations in the early days of the pandemic, you may have wanted to sell your stock holdings due to fear. Conversely, if you were encouraged by the stock market's strong performance in 2023, you may have wanted to pour all your money into equities. Yet either of these actions might not have been appropriate for your investment goals and personal circumstances.

Risk of Missing Out

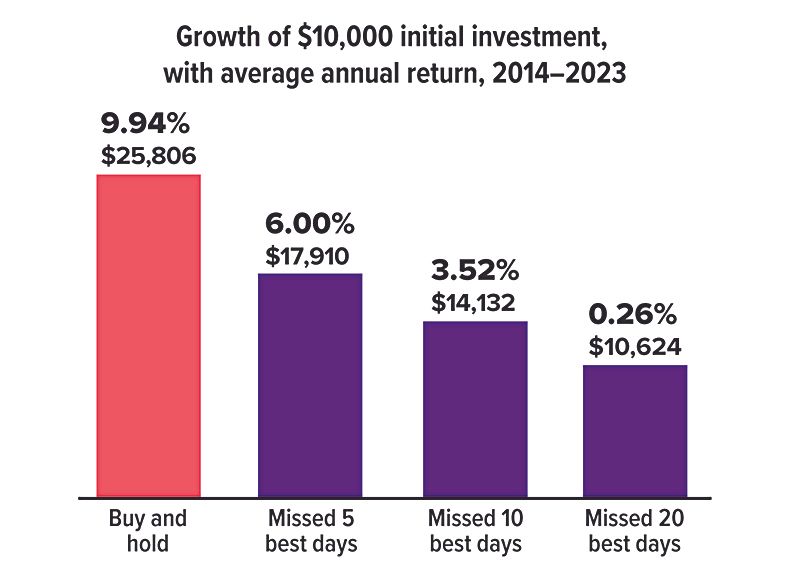

Emotion-based decisions can have a significant impact on your portfolio over time. Consider how much a long-term investor might have lost by shifting in and out of the market due to fear, overconfidence, or following the herd, and subsequently missing the best-performing days over the 10-year period ended 2023.

An objective view can help

When it comes to our finances, instincts may work against us. Before taking any actions with your portfolio, it might be wise to seek the counsel of a qualified financial professional who can help you identify any unconscious biases at work.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful. There is no assurance that working with a financial professional will improve investment results.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.