Fine-Tuning with Sector Funds

As its name suggests, the S&P 500 Index contains about 500 stocks.

These represent the largest U.S. companies across a broad range of industries, and the index as a whole is generally considered representative of the U.S. stock market. But though index ups and downs may suggest uniform market movements, performance of individual companies and business sectors varies widely.

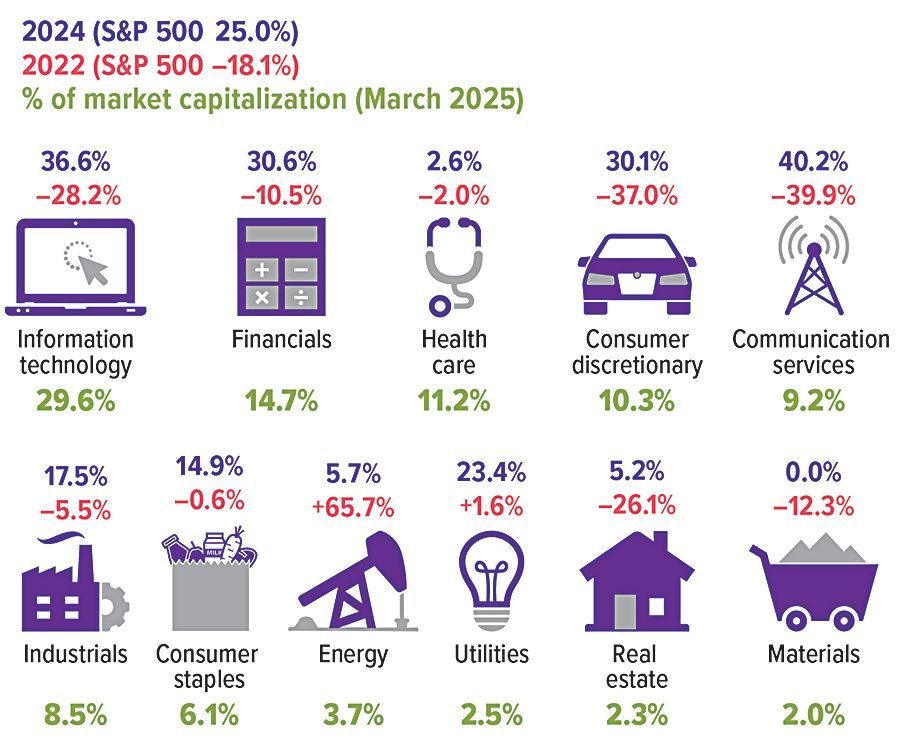

Stocks in the S&P 500 are classified by 11 sectors, each of which responds differently to market conditions. In 2024, a banner year for the index, the strongest performing sectors were communication services, information technology, financials, and consumer discretionary (see chart). These sectors tend to perform well when the economy is strong and can drop as quickly as they rise when conditions change. Other sectors — such as health care, consumer staples, and utilities — are considered "defensive" and may be good to hold through a bear market or recession because businesses in these sectors tend to remain strong regardless of economic conditions.

Index weighting

Many broad-based indexes, including the S&P 500, are weighted based on market capitalization — the total value of a company's outstanding stocks. Sectors have different sizes and weighting to begin with, and weight can change significantly due to growth of companies within the sector. For example, the information technology sector, which includes some of America's largest companies, rose from 20.1% of S&P 500 capitalization at the end of 2018 to 29.6% in March 2025, increasing its impact on the index. The health care sector dropped from 15.5% to 11.2% over the same period, decreasing its impact on the index.1-2

This means that even if you invest primarily in broad-based index funds, you may be more heavily invested (overweight) or less invested (underweight) in a given sector than you realize. If you own individual stocks or funds with a more specific focus, your portfolio could be even more overweighted or underweighted. The appropriate sector weighting for your stock portfolio depends on your goals, risk tolerance, and economic outlook.

Sector funds

One way to shift sector weight in your portfolio is by adding one or more sector funds — mutual funds or exchange-traded funds (ETFs) that focus on stocks of companies in a particular industry or sector of the economy. These funds are available for many indexes, including those that focus on smaller companies. Because sector funds are less diversified, they typically carry a higher level of volatility and risk than broad-based funds and should be considered as a complement to a core portfolio of diversified funds rather than a replacement.

Varied Weight and Performance

This chart shows the total return for S&P 500 sectors in an up-market year (2024) and a down year (2022), with sector weighting below the icons.

Sector funds

One way to shift sector weight in your portfolio is by adding one or more sector funds — mutual funds or exchange-traded funds (ETFs) that focus on stocks of companies in a particular industry or sector of the economy. These funds are available for many indexes, including those that focus on smaller companies. Because sector funds are less diversified, they typically carry a higher level of volatility and risk than broad-based funds and should be considered as a complement to a core portfolio of diversified funds rather than a replacement.

Although sector funds offer flexibility in fine-tuning your portfolio, it's important to resist the temptation to chase performance and move assets into "hot" sectors without a more comprehensive strategy. Sector performance is cyclical, and last year's hot sector can easily turn cold. Also keep in mind that every business cycle is different, and unexpected events can disrupt regular trends.

The return and principal value of all investments, including sector funds, fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. Asset allocation and diversification are methods used to help manage investment risk; they do not guarantee a profit or protect against investment loss.

Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

(1) S&P Dow Jones Indices, 2025

(2) Siblis Research, 2022 (historical data)

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.