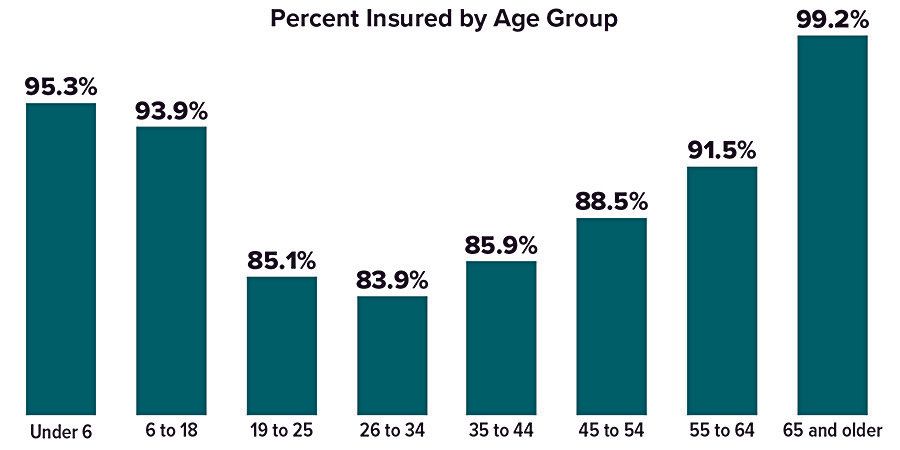

Young Adults Are More Likely to Lack Health Coverage

Children are often covered by a parent's health plan or by public health insurance such as the Children's Health Insurance Program (CHIP).

But young adults generally lose eligibility for CHIP at age 19 and for coverage under a parent's health plan at age 26. Before they transition into employer-sponsored health plans or buy private health insurance, young adults are more likely to be uninsured than other age groups.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.