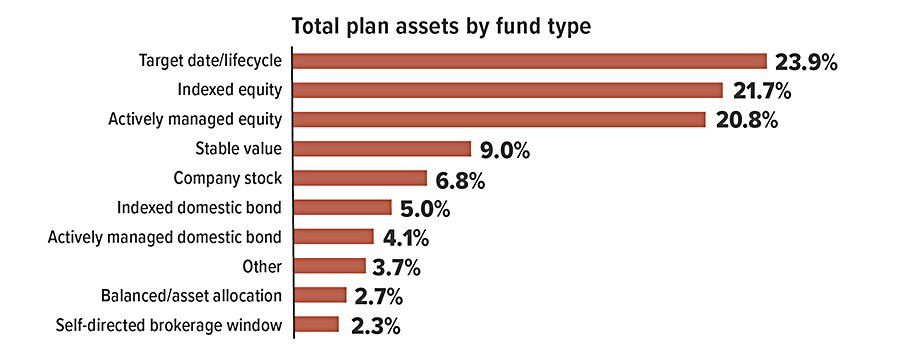

How Are 401(k) Plan Participants Investing Their Money?

Created in 1996, National 401(k) Day has historically been celebrated on the Friday following Labor Day to shine a spotlight on this important employee benefit. Since the late 1990s, plans have evolved substantially, and most participants can now choose from a diverse variety of investments. The chart below shows how 401(k) and profit-sharing funds were invested in 2020.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.