Investor confidence was continually tested as the year wore on, and it's likely that this percentage rose — perhaps even substantially. If you find yourself among those feeling stressed heading into the new year, these tips may help you focus and enhance your retirement savings strategy in 2021.

1. Consider increasing your savings by just 1%

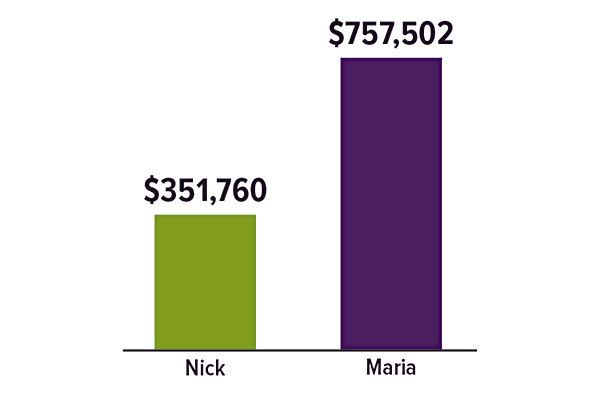

If you participate in a retirement savings plan at work, try to increase your contribution rate by just 1% now, and then again whenever possible until you reach the maximum amount allowed. The accompanying chart illustrates the powerful difference contributing just 1% more each year can make over time.

2. Review your tax situation

It makes sense to review your retirement savings strategy periodically in light of your current tax situation. That's because retirement savings plans and IRAs not only help you accumulate savings for the future, they can help lower your income taxes now.

Every dollar you contribute to a traditional (non-Roth) retirement savings plan at work reduces the amount of your current taxable income. If neither you nor your spouse is covered by a work-based plan, contributions to a traditional IRA are fully deductible up to annual limits. If you, your spouse, or both of you participate in a work-based plan, your IRA contributions may still be deductible unless your income exceeds certain limits.

Note that you will have to pay taxes on contributions and earnings when you withdraw the money. In addition, withdrawals prior to age 59½ may be subject to a 10% penalty tax unless an exception applies.

3. Rebalance, if necessary

Market turbulence throughout the past year may have caused your target asset allocation to shift toward a more aggressive or conservative profile than is appropriate for your circumstances. If your portfolio is not rebalanced automatically, now might be a good time to see if adjustments need to be made.

Typically, there are two ways to rebalance: (1) you can do so quickly by selling securities or shares in the overweighted asset class(es) and shifting the proceeds to the underweighted one(s), or (2) you can rebalance gradually by directing new investments into the underweighted class(es) until the target allocation is reached. Keep in mind that selling investments in a taxable account could result in a tax liability. Asset allocation is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.

4. Revisit your savings goal

When you first started saving in your retirement plan or IRA, you may have estimated how much you might need to accumulate to retire comfortably. If you experienced any major life changes during the past year — for example, a change in job or marital status, an inheritance, or a new family member — you may want to take a fresh look at your overall savings goal as well as the assumptions used to generate it. As circumstances in your life change, your savings strategy will likely evolve as well.

5. Understand all your plan's features

Work-based retirement savings plans can vary from employer to employer. How familiar are you with your plan's specific features? Does your employer offer a matching and/or profit-sharing contribution? Do you know how it works? Are company contributions and earnings subject to a vesting schedule (i.e., a waiting period before they become fully yours) and, if so, do you understand the parameters? Does your plan offer loans or hardship withdrawals? Under what circumstances might you access the money? Can you make Roth or after-tax contributions, which can provide a source of tax-free income in retirement? Review your plan's Summary Plan Description to ensure you take maximum advantage of all your plan has to offer.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

(1) Employee Benefit Research Institute, 2020

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.