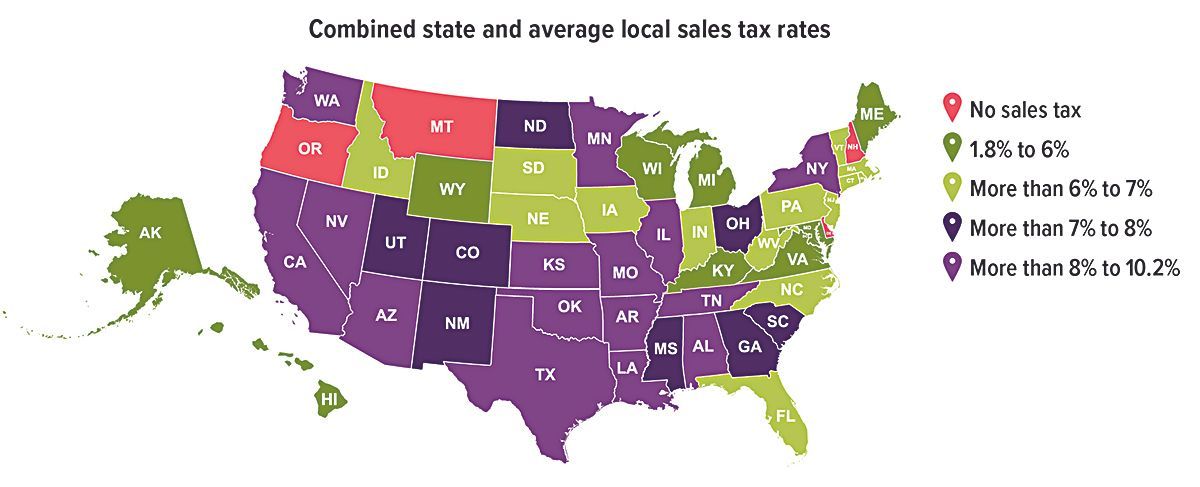

State and Local Sales Tax Across the Map

Among the 46 states (and the District of Columbia) with a state and/or local sales tax, the combined state and average local sales tax rates range from about 1.8% to 10.2%. The sales tax base (defining what is taxable and nontaxable) can also vary greatly. Some states exempt groceries and/or clothing from the sales tax or tax them at a reduced rate. Five states have no statewide sales tax, and of those, only Alaska allows local sales taxes.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.