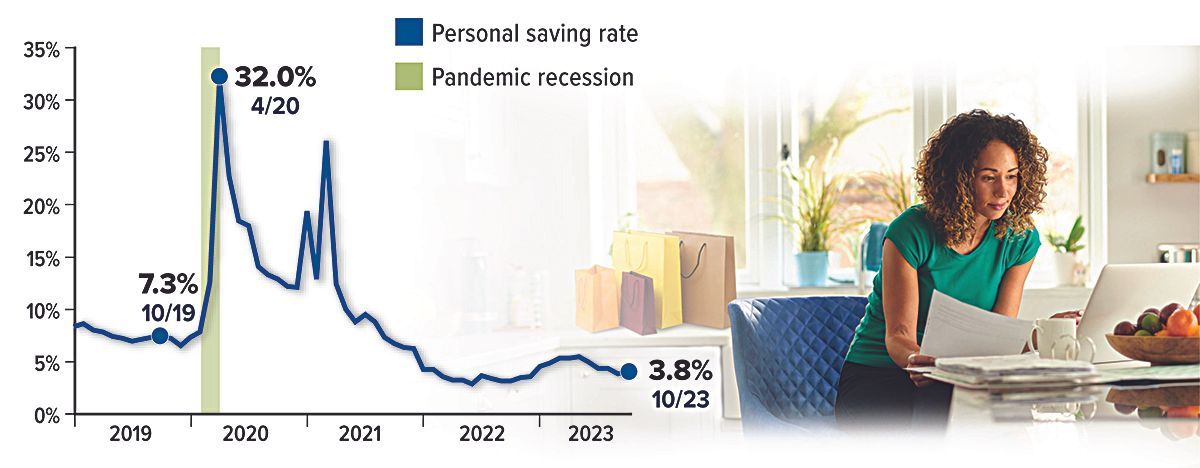

Saving Less? You're Not Alone.

The U.S. personal saving rate — the percentage of personal income that remains after taxes and spending — was 3.8% in October 2023. The saving rate spiked to an all-time high during the pandemic, when consumers received government stimulus money with little opportunity to spend, but fell quickly as stimulus payments ended and high inflation ate into disposable income. The current level is well below pre-pandemic saving rates.

A low personal saving rate means there is less money available on a monthly basis for saving and investment. However, many households still have pandemic-era savings, and the low rate indicates consumers are willing to spend, which is good for the economy. The question is how long this spending can be sustained.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.