Financial Regrets

A 2023 survey found that about three out of four U.S. adults had a financial regret.

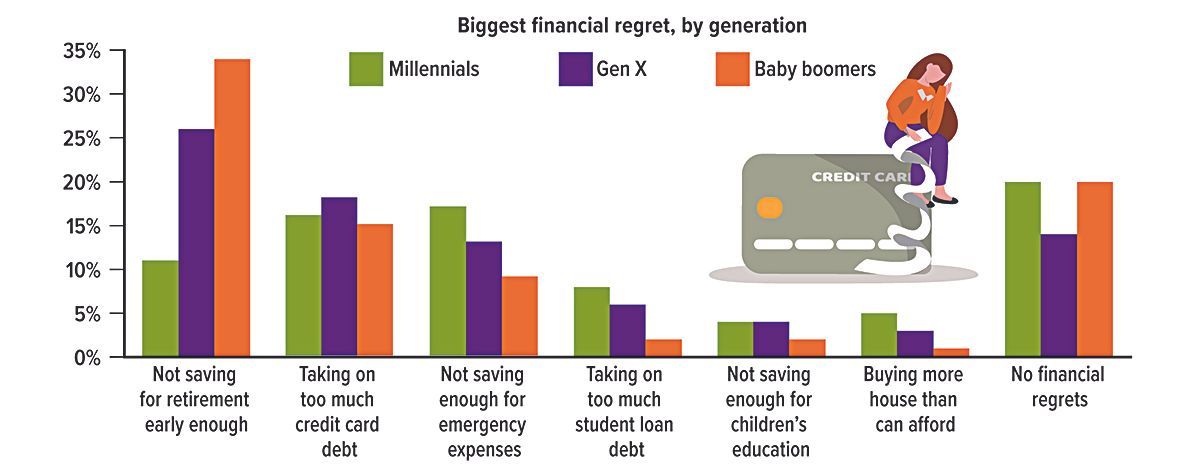

The most common were not saving for retirement early enough, taking on too much credit card debt, and not saving enough for emergency expenses. It's probably not surprising that the weight that people placed on these and other regrets varied by generation — and regret about not saving early enough for retirement was higher for those closer to retirement age.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.